Whether you are a fresh graduate or a seasoned practitioner who wants to upgrade dental equipment, starting a dental practice is a significant endeavor. It requires careful planning, a clear vision, and substantial financial investment.

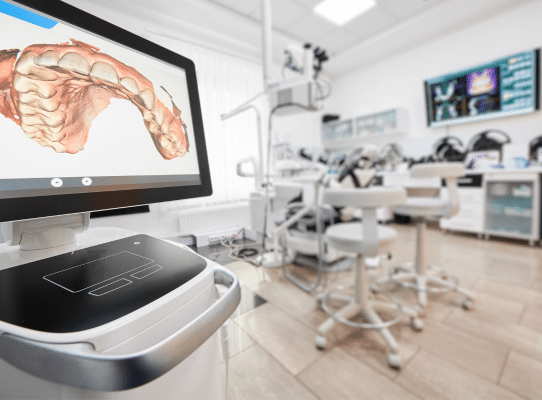

One of the critical aspects of establishing a successful dental clinic is acquiring the necessary equipment, which can be a daunting burden for many new practitioners. This article explores the various options for dental equipment financing.

What is Dental Equipment Financing?

Dental equipment financing refers to several financial solutions designed to help dental professionals acquire the essential tools and technology. As we know, dental equipment costs a lot.

Hence, many dental practitioners find it challenging to make these purchases outright. Dental equipment financing provides a way to spread these substantial costs over time. It can ease the financial burden and preserve cash flow for other critical areas of the practice.

There are several types of dental equipment financing options available:

Traditional Bank Loans: Banks and credit unions provide these equipment loans for dentists. They may require a strong credit history and substantial documentation.

Equipment Financing: This is a specialized loan where the purchased equipment itself serves as collateral. What is the interest rate on equipment finance? It offers fixed interest rates and predictable monthly payments. It is a manageable option for many practices.

Equipment Leasing: This allows practices to rent equipment for a specified period, often with the option to purchase the equipment at the end of the lease term. Dental equipment leasing can be a cost-effective way to access the latest technology without initial investment.

Small Business Administration (SBA) Loans: These government-backed loans offer lower down payments and longer repayment terms.

How Does Dental Equipment Financing Work?

Dental equipment financing helps dental professionals acquire essential tools and technology without the financial strain of upfront costs.

1. Assessing Needs and Budget

The first step is to determine what equipment you need and establish a budget. This involves identifying essential tools such as dental chairs, imaging systems, sterilization units, and other necessary devices.

2. Researching Financing Options

Various financing options are available, including traditional bank loans, equipment financing, equipment leasing, and SBA loans. Each option has its own set of terms, interest rates, and repayment schedules. Researching and comparing these options helps in choosing the most suitable financing solution.

3. Application Process

Once you select a financing option, the next step is to apply for financing. This typically involves filling out an application form and providing necessary documentation such as financial statements, tax returns, and business plans. Lenders will assess the application based on the practice’s creditworthiness and financial health.

4. Approval and Terms Agreement

After reviewing the application, the lender will decide on approval. If approved, the lender will outline the terms of the financing agreement, including interest rates, repayment schedule, and any other conditions.

5. Receiving Funds and Purchasing Equipment

Upon agreeing to the terms, they will disburse the funds. The practice can then proceed to purchase the necessary equipment.

6. Repayment

The repayment phase involves making regular payments as per the agreed schedule. This might be monthly, quarterly, or annually, depending on the financing terms.

How Does Dental Equipment Financing Help Start-Ups?

Dental equipment financing is a lifeline for startups. It provides access to essential tools without the hefty initial outlay. By spreading costs over time, new practices can maintain cash flow for other critical needs such as marketing, staffing, and operational expenses.

Financing options enable startups to acquire the latest technology, ensuring they can offer high-quality care from the outset. Additionally, with flexible terms and potential tax benefits, financing helps startups manage their finances more effectively.

How to Choose Options for Dental Equipment Financing in 2024

Which type of finance should be used to purchase new machines and equipment? Choosing the right dental equipment financing in 2024 requires careful consideration of several factors to ensure you make a financially sound decision.

Evaluate Financing Options

Compare different financing solutions such as traditional bank loans, equipment financing, leasing, and SBA loans. Each option has its benefits and limitations, so you need to understand the terms, interest rates, and repayment schedules.

Check Eligibility Criteria

Ensure you meet the eligibility requirements for the chosen financing options. Factors like credit score, business history, and financial health play a significant role in approval.

Interest Rates and Terms

Look for financing with competitive interest rates and favorable terms. Fixed-rate loans provide predictable payments, while variable rates might offer lower initial costs.

Flexibility and Customization

Choose a financing plan that offers flexibility in repayment schedules and allows for customization based on your business needs.

Tax Implications

Consider the tax benefits associated with different financing options. Some equipment financing may offer deductions that can reduce your overall tax liability.

Reputation of Lender

Opt for reputable lenders with a track record of working with dental practices. Read reviews, seek recommendations, and consult with industry peers to find reliable financing partners.

How to Apply for Dental Equipment Financing

Follow these steps if you want to file application for any dental equipment financing:

Step 1: Prepare Documentation

- Gather the required documentation, which typically includes:

- Business plan

- Financial statements (profit and loss, balance sheet)

- Tax returns (personal and business)

- Personal and business credit scores

- Equipment quotes or invoices

Step 2: Complete the Application

Fill out the financing application form provided by the lender. Ensure that all information is accurate and complete to avoid delays in processing.

Step 3: Submit Documentation

Submit the gathered documentation along with your completed application. You can do it online, via email, or in person, depending on the lender’s process.

Step 4: Lender Review

The lender will review your application and documentation, assessing your creditworthiness and financial health. This may involve a credit check and a review of your business’s financial history.

Step 5: Approval and Terms Agreement

If approved, the lender will present you with the financing terms, including interest rates, repayment schedule, and any other conditions. Review the terms carefully and negotiate if necessary. Lastly, you will receive the funds after the whole process is completed.

Final Thoughts

Dental equipment financing is an invaluable tool for new and established practitioners. If you’re ready to equip your dental practice with the latest tools and technology, consider ROK Financial.

They offer equipment financing at reasonable interest rates and a simple 15-second application process. Don’t let financial constraints hold you back from growing your practice. Contact ROK Financial and take the next step toward a stellar dental practice.